What is Bizum and how does it work?

Bizum is the instant mobile payment solution jointly promoted by Spanish banks. It allows you to send money between individuals quickly and conveniently as an alternative to bank transfers by avoiding having to ask for the IBAN of your bank to the person you are sending the money to.

Advantages of using Bizum

- Universality: you don't need to change bank and it is available on any smartphone, allowing you to interact with practically all of them.

- Convenience: you only need to know the mobile phone number (or select their contact in your phone's address book) of the person receiving the payment.

- Speed: the transfer of funds takes less than 5 seconds.

- Security: it has the backing of the Spanish banking system, its applications and security measures.

As it is a system integrated directly into the application of each bank, you do not need to download any extra app to use it, just check that your bank's App has this system. Here is a list of compatible banks that have already implemented the service.

Make your online purchases with Bizu

Make your online purchases with Bizum quickly and securely without having to enter your card number as the payment is identified with your phone number.

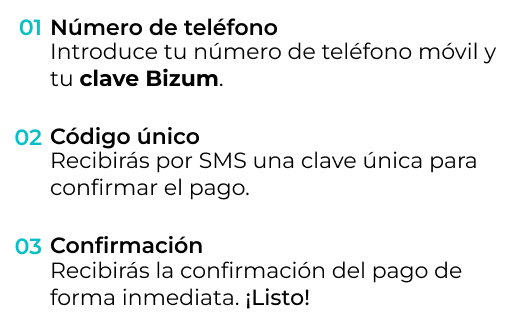

How to pay for your purchases with Bizum?

To make your purchases you only have to select the option ‘pay with Bizum’ and enter your mobile phone number and your Bizum code, a four-digit code that you will obtain when you register for this service. After this, your bank will send you a code to confirm the transaction.

How does payment with Bizum work in online shops?

- Choose ‘Pay with Bizum’ as your payment method when you make your online purchase.

- Enter your telephone number and Bizum code.

- Validate the transaction by including the code provided by your bank via SMS.

What is the Bizum key?

The Bizum key is a 4-digit code, with which you will be able to buy in all the shops that have the Bizum button as a payment method available and which is obtained from the app of each bank.

How do I get my Bizum key?

You can get it from your bank's app, go here and click on your bank's logo for more information. You can change it whenever you want from this app.

My Bizum bank does not offer me the Bizum key, can I buy online?

If your bank does not have the Bizum key, it means that it is working to offer e-commerce payments. Another possibility is that your bank already allows you to complete payments with Bizum directly in its banking app. To do this, you only have to enter your phone number at the time of payment and you will receive a notification from your bank to complete the payment in its app.

What guarantees do I have when making an e-commerce purchase with Bizum?

Bizum, as an instant account-to-account payment method, offers the maximum guarantee of security in accordance with the standards regulated by the European Union and Spanish legislation. The payment is made in a totally secure way with Bizum through your bank, which finally validates the transaction. Product delivery and return guarantees should be checked with the retailer in each case.

How do I return a product purchased with Bizum?

As with other payment methods, the product return policy is governed by the conditions established by the shop where you have made the purchase. You must speak to the merchant to manage and, if necessary, return the payment.

Is there any cost for the buyer?

Paying with Bizum at the merchant has no cost for the user. So no, we do not charge you any commission when you click on the payment button.

Secure payment with Bizum

As it is a system integrated into the mobile application of each bank, the security will be the same as that used by the application itself. You must access your bank's app, and then enter a PIN to validate each transaction, which is also verified by an SMS sent to the associated phone number, making it much more secure than certain traditional payments. More than 20 million users currently use this service (21.2% growth). Bizum is currently the second favourite payment option for consumers (20 million users) in those merchants that offer this service (there are already 31,000) and 3.25 million transactions of this type have already been carried out in 2022.